Financial statements in construction are like blueprints for a company’s financial health. Just as blueprints guide the construction of a building, financial statements – including the Balance Sheet, Income Statement, and Cash Flow Statement, along with the Work-in-Progress (WIP) Report – are essential for building a strong financial foundation. They provide a snapshot of the company’s financial activities, revealing where money is coming from and where it’s going. These documents help identify financial strengths and intricacies, enabling informed decision-making in the complex world of construction financial management.

Financial statements are of paramount importance in the construction industry for several compelling reasons.

Project Viability: Construction projects often require significant upfront investment. Financial statements help assess whether a company has the resources to fund these projects and complete them successfully.

Credibility: Reliable financial statements enhance a company’s credibility and make it more attractive to clients knowing that they can get paid on time, investors seeking to fuel business growth, and bonding & surety’s to lend for projects.

Strategic Decision Making: Financial statements provide essential data for making informed business decisions and assessing risks. This can help identify areas needing cost control and planning for upcoming investment decisions into expansion such as hiring, purchasing equipment, business development, and employee well-being.

Compliance: In a regulatory environment similar to construction projects following specific plans and regulations, construction companies must also adhere to financial regulations. Properly prepared financial statements are essential for ensuring compliance with these financial rules, ultimately fostering trust and integrity in the industry.

The income statement, often referred to as the profit and loss statement (P & L), is the report that unravels whether a construction company’s efforts have translated into profitability or financial challenges. It’s one of the most eagerly anticipated reports, as it answers the fundamental question: are we making money? This financial document encapsulates the company’s financial performance during a specific period, commonly a month, quarter, or year.

The income statement meticulously compiles transactions from various general ledger accounts, offering a concise summary of financial activity over the designated timeframe. By comparing these reports across similar timeframes, stakeholders gain valuable insights into the company’s financial trajectory. This report paints a financial picture, showcasing both the revenue earned and the expenses incurred during the period. Ultimately, the bottom line of the statement reveals the net income or profit, a figure of utmost significance. Construction companies typically generate this statement on a monthly or annual basis, providing a window into the financial health and profitability of the business.

Income – Expenses = Net Profit (or Loss)

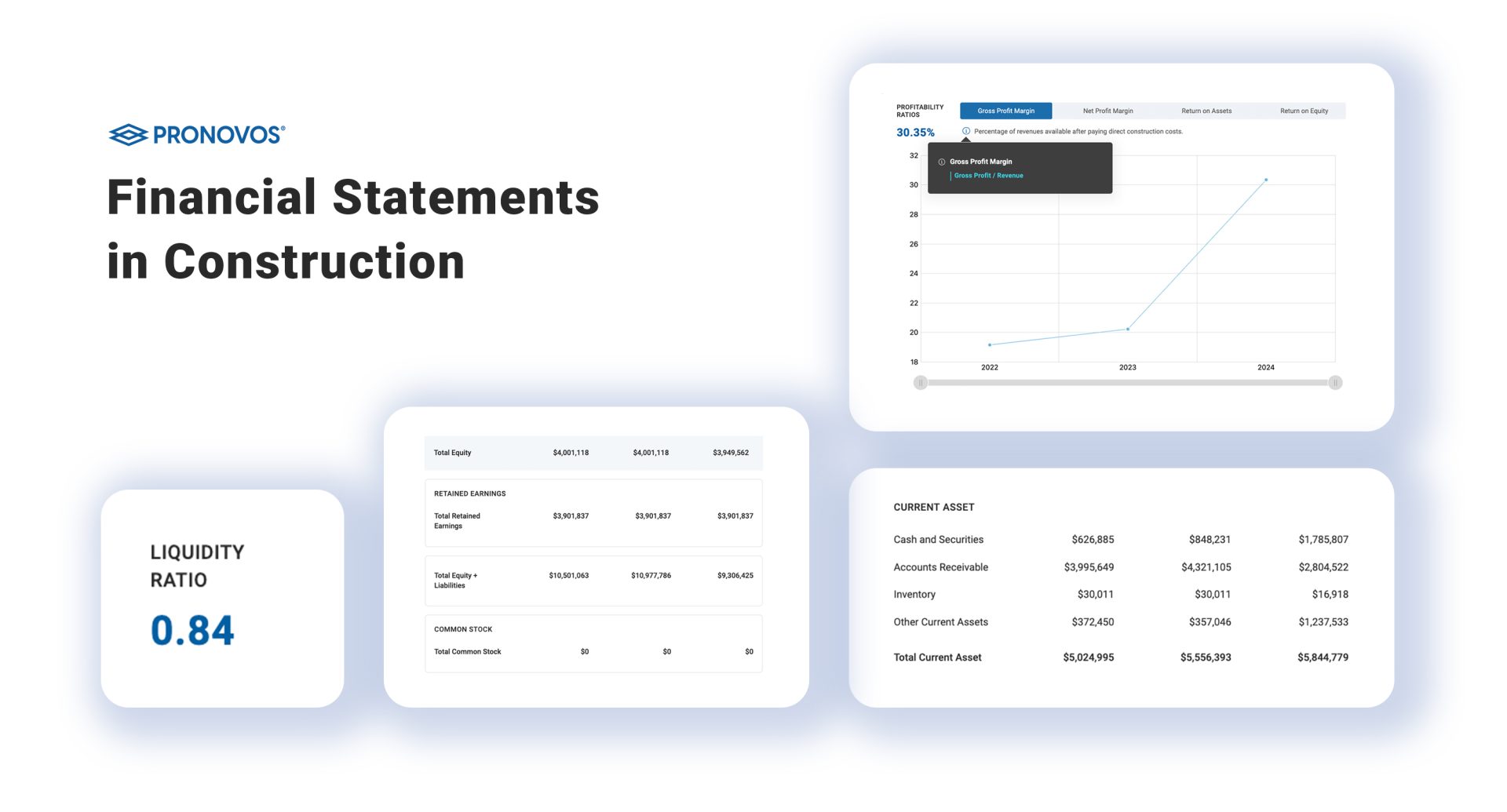

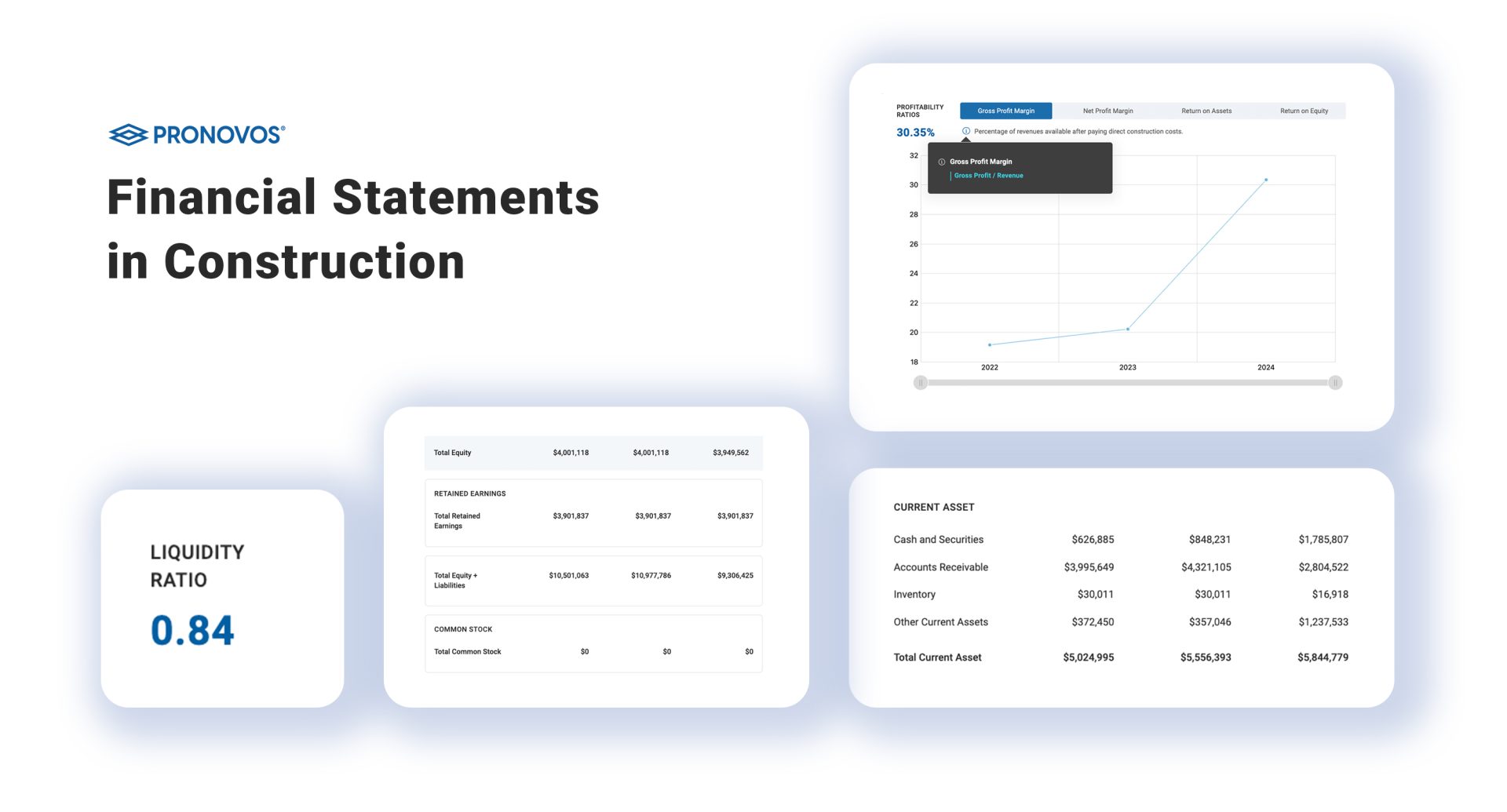

The balance sheet serves as a financial snapshot, revealing a construction company’s liquidity at a specific point in time. This report aims to harmonize the company’s assets with its obligations, providing insights into its financial standing. In the construction industry, where timely financial decisions are as vital as the projects themselves, the balance sheet is crucial for assessing the company’s ability to meet its financial commitments. It’s not just an internal financial compass; it’s a document that banks and vendors scrutinize to determine creditworthiness and bonding capacity.

Typically prepared at the end of a financial period, such as a quarter or year, the balance sheet neatly categorizes its elements into three key sections: Assets, Liabilities, and Equity. Let’s explore each section to better understand how they collectively shape the financial landscape of a construction business.

Assets = Liabilities + Owner’s Equity

The cash flow statement, distinct from the balance sheet and profit and loss statement, serves a unique purpose by focusing on non-cash assets and liabilities. While you might consider relying on your general ledger’s cash account balances, the cash flow statement provides added value. It not only verifies your financial records but also details the sources and uses of cash in your company, be it from operating, investing, or financing activities.

This report offers a precise account of cash movements during a specific period, solely based on cash transactions and offers a more accurate financial reflection. It’s also known as a statement of cash flows. Categorizing financial activities into three types: Operating, Investing, and Financing, it tracks day-to-day business transactions, fixed asset transactions, and financing activities like stock sales. By showing the net gain or loss in these activities and summarizing the period’s financial outcome, it aids in financial forecasting and provides valuable insights for effective financial management, akin to income statements for revenue trends.

[Starting Cash + Cash In – Cash Out] = Cash Flow

Cash flow projections or forecasting are pivotal in ensuring the financial stability and success of a business. These forecasts allow companies, including those in the construction industry, to anticipate and plan for their future financial needs. By projecting cash inflows and outflows, businesses can identify potential cash shortages or surpluses, allowing for proactive cash flow management. Cash flow projections also aid in making informed decisions about investments, financing, and operational strategies, which are especially critical in industries with substantial financial commitments, such as construction. Moreover, these forecasts provide a safeguard against unforeseen financial crises and monitor your line of credit, enabling companies to weather economic challenges and seize growth opportunities.