Make a Spending Plan

A spending plan (also called a budget) is simply a plan you create to help you meet expenses and spend money the way you want to spend it. A good spending plan can help you stop “spending leaks”; in other words, it can keep you from spending money without thinking. It can help you make sure you have money to pay bills on time, even when your bills and income change each month. A spending plan can help you know your daily spending and reach your long-term goals.

This module takes about 30 minutes to complete. By the end of this module, you will be able to…

- …make your own spending plan that includes all your expenses and income.

- …determine how much you need to save regularly for irregular and/or unexpected expenses like car repairs and insurance payments.

- …describe the benefits of tracking spending.

Before you get started, let’s find out what you already know by warming up with a few questions. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

A spending plan should include all of your money coming in, money going out, and money put towards savings.

True, in addition to regular monthly payments such as rent and bills, a spending plan should also include irregular payments such as family trips, medical co-pays and deposits to savings.

You need to make a different spending plan for each month because expenses go up and down from month to month.

False, a good monthly spending plan stays relatively stable month to month, even as bills and income go up and down. This kind of plan includes “set-aside” money that is saved for future bills and expenses.

Most financial institutions allow you to automatically transfer a portion of your paycheck to a savings account for free.

True, automatic transfers ($50 per pay-check for example) are a good way to save for future expenses like car repairs and insurance bills.

A spending plan or budget includes:

- Money coming in – paychecks, tips, loans, scholarships, child support, and other cash benefits

- Money going out – regular monthly bills, like housing, groceries, utilities, clothing, childcare, car payment, credit cards, doctor bills, loan payments – well, you get the idea

- Goals – money set aside for emergencies, replacing your vehicle, a family trip, medical co-pays, paying off credit card debt, retirement, education, or other future expenses

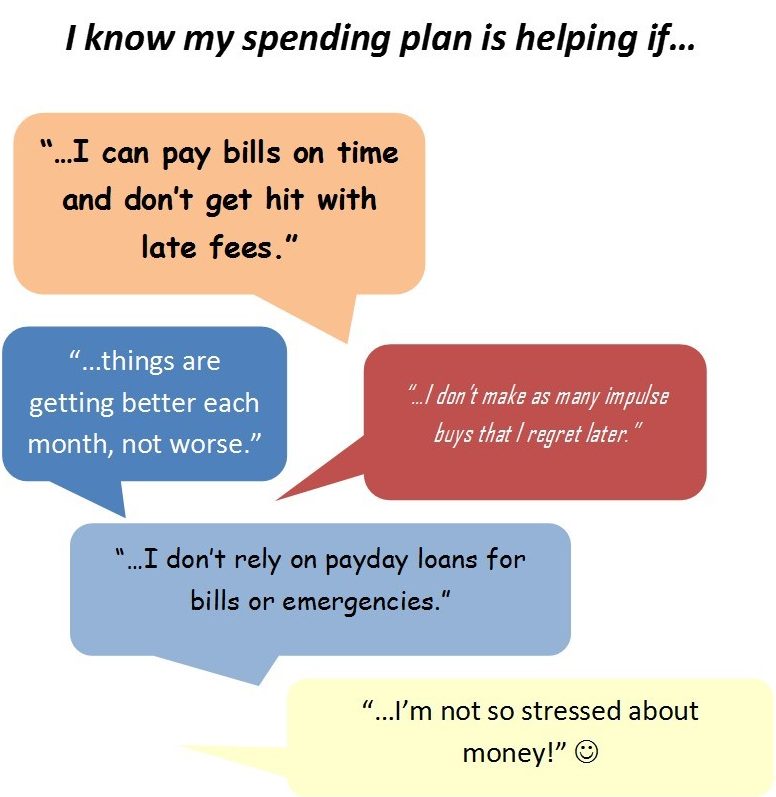

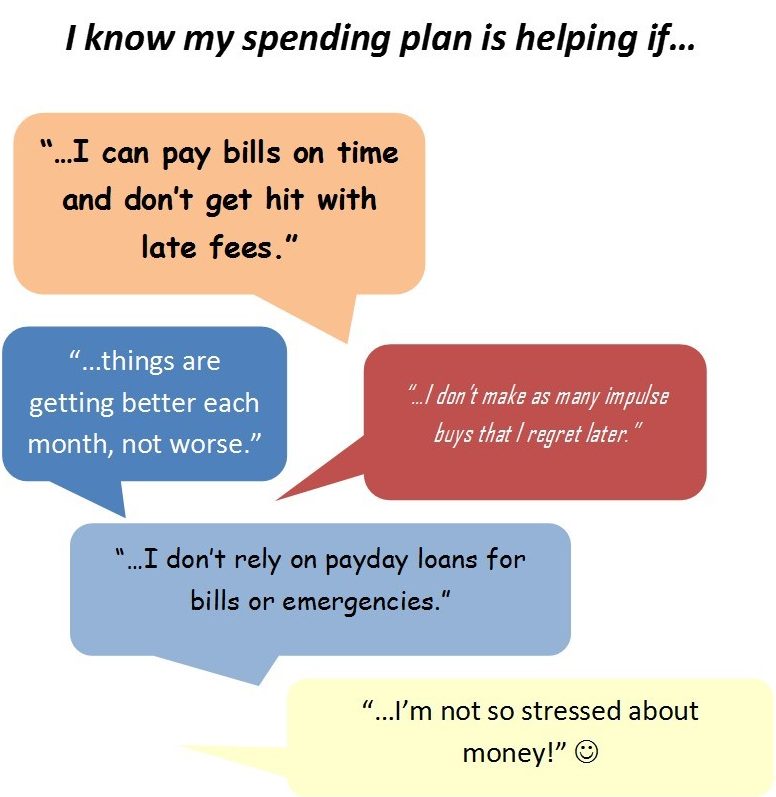

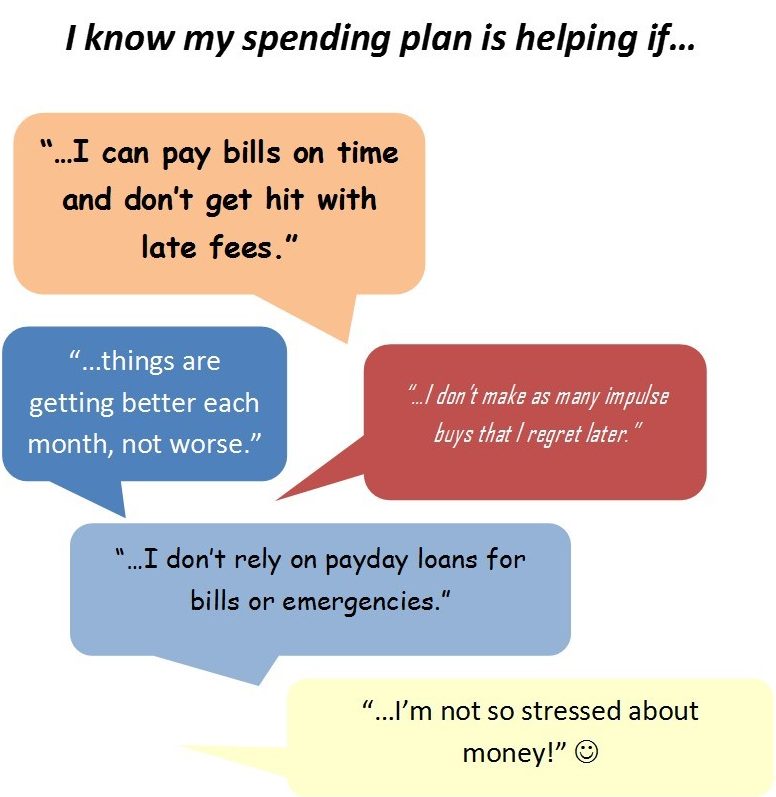

How do you know when your spending plan is good enough?

Creating a spending plan is a process. Try it, then tweak it to make improvements and try it again. It is never perfect, but if you keep working at it and improving it, you’ll get to a place where it’s good enough.

Making a spending plan may seem like a lot of work. It may take a little time upfront but once you’re using it regularly it can be a great tool to help you cut down on stress, reach your goals, and put control of your money in your hands.

To learn how to make and follow a spending plan, check out the resources below. Then take the quiz.

- Creating a Spending Plan – Watch this video on why and how to create your own spending plan.

- 4 Steps to a Spending Plan – Follow this step-by-step guide to learn how to create a spending plan.

- Once you know what you’d like your spending plan to be, keep track of your spending. You’ll learn a lot more about your habits and what expenses are most important to you. Some tools to help with tracking spending include:

- Spending Tracker – Download and save this worksheet to your computer to help you keep track of your expenses each month. It also totals up your monthly spending for you.

- UW Spending Plan spreadsheet – You can download this worksheet and save it to your computer to track your monthly spending. Plus it adds up your income and expenses for you.

- You could also print this weekly wallet tracker to write down your daily spending. Available in English and Spanish.

- Setting financial goals can help you improve your financial situation:

- When you know what goals you want to work toward, this worksheet can help you turn your goals work into SMART Goals.

More tips and tools to balance a budget

Here are some more resources that can help with spending plans and balancing a budget.

Getting Through Tough Times – Are you spending more than your income? Consider these suggestions to help when money is tight.

Managing spending – Looking for ideas on how to get your spending to match your income. Check out this resource from the Consumer Financial Protection Bureau.

Sharon’s Story – Spending doesn’t always go as planned each month! Read about Sharon and see if you can help her improve her spending plan.

Spending Your Money – A summary about spending plans from the UW-Extension Money $mart program.

Budgeting & Planning Tools – Check out more budgeting worksheets and other tools you can download to help you plan to meet expenses.

Savings goals belong on your spending plan too. Watch this video to learn steps to get you closer to your financial goals.

Test your knowledge

Spending Plan Quiz Take this 10-question quiz to review the basics and test your knowledge. You can take this quiz as many times as you want.

Certificate of Completion

If you’d like to certify that you’ve completed this module, be sure to contact a UW-Madison Extension Financial Educator to find out about program requirements.

Modules

- Learn About Your Financial Strengths

- Make a Spending Plan

- When you can’t pay your bills…

- Saving Money

- Managing Student Loans

- Credit Report & Score Basics

- Debt Management

- Health Insurance Basics

- Health Insurance Options for Wisconsin Residents

- Staying Organized

- You, Your Partner, and Your Money

- Retirement Planning Basics

- Credit Unions, Banks, and Other Financial Institutions

- Veterans and Finances

- Navigating Non-bank Financial Technology Alternatives

- Prepare un plan de gastos

- Cuando no puede pagar sus cuentas…

- Manejo de préstamos para estudiantes

- Principios básicos para planificar la jubilación

- Cooperativas de crédito, bancos y otras instituciones financieras

Search this course:

UW Extension Educator Resources

Additional Money Matters resources are available for UW-Madison Division of Extension educators.