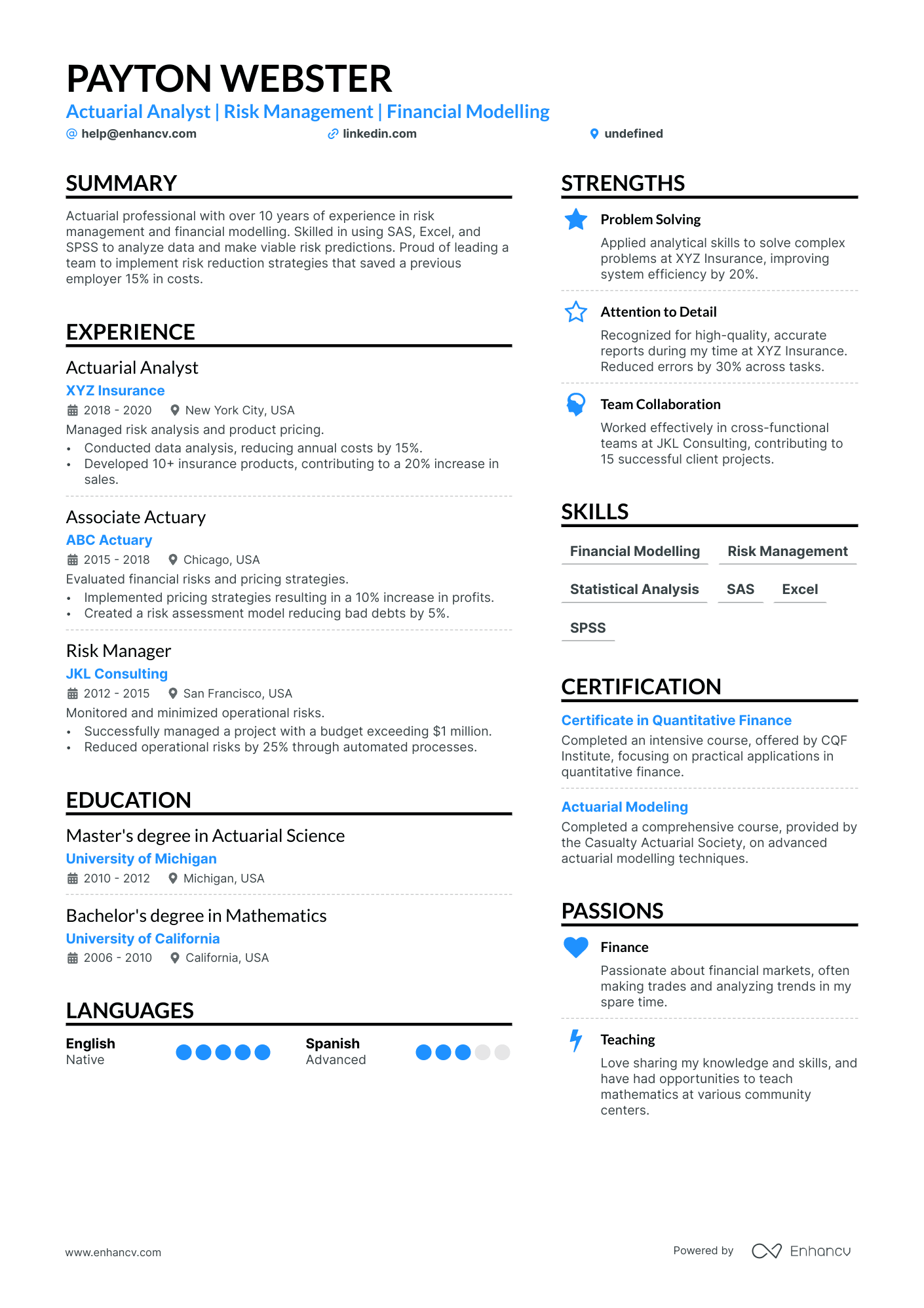

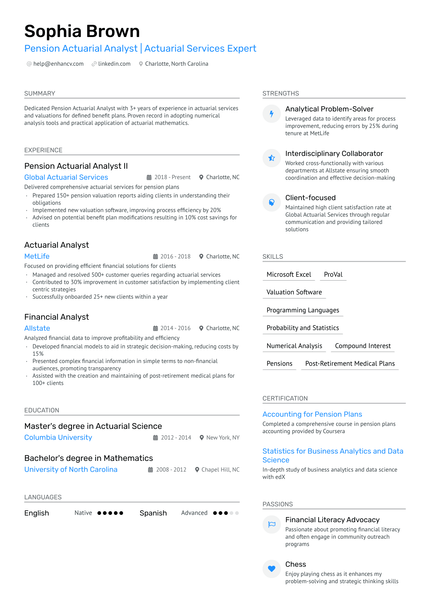

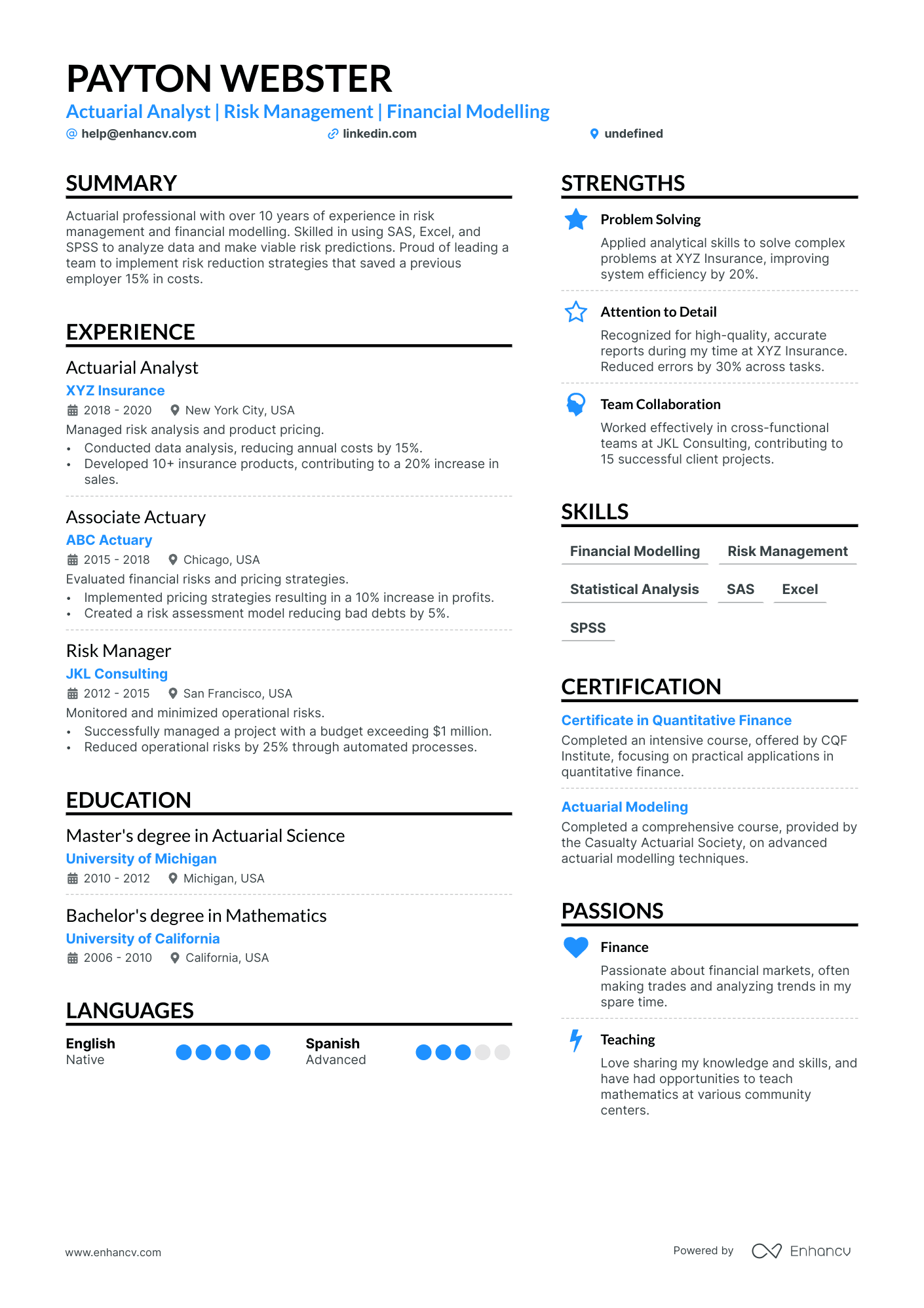

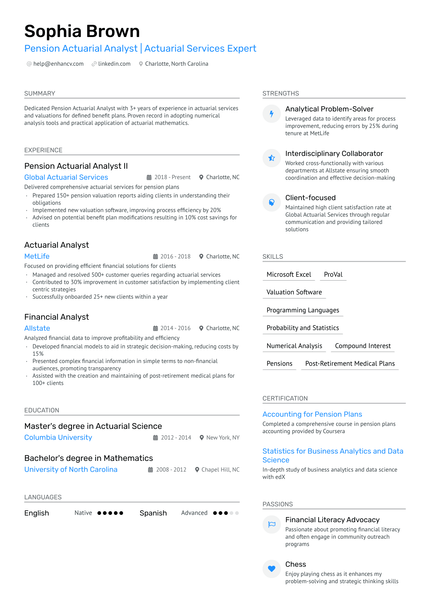

Actuaries analyze financial risks using mathematics, statistics, and financial theory. Highlight your experience with risk assessment, proficiency in statistical software, and knowledge of insurance products in your resume. Include analytical thinking, problem-solving abilities, and strong communication skills to enhance your qualifications. Emphasize your contributions to previous projects and any successful cost-saving strategies you've implemented to demonstrate your worth to potential employers.

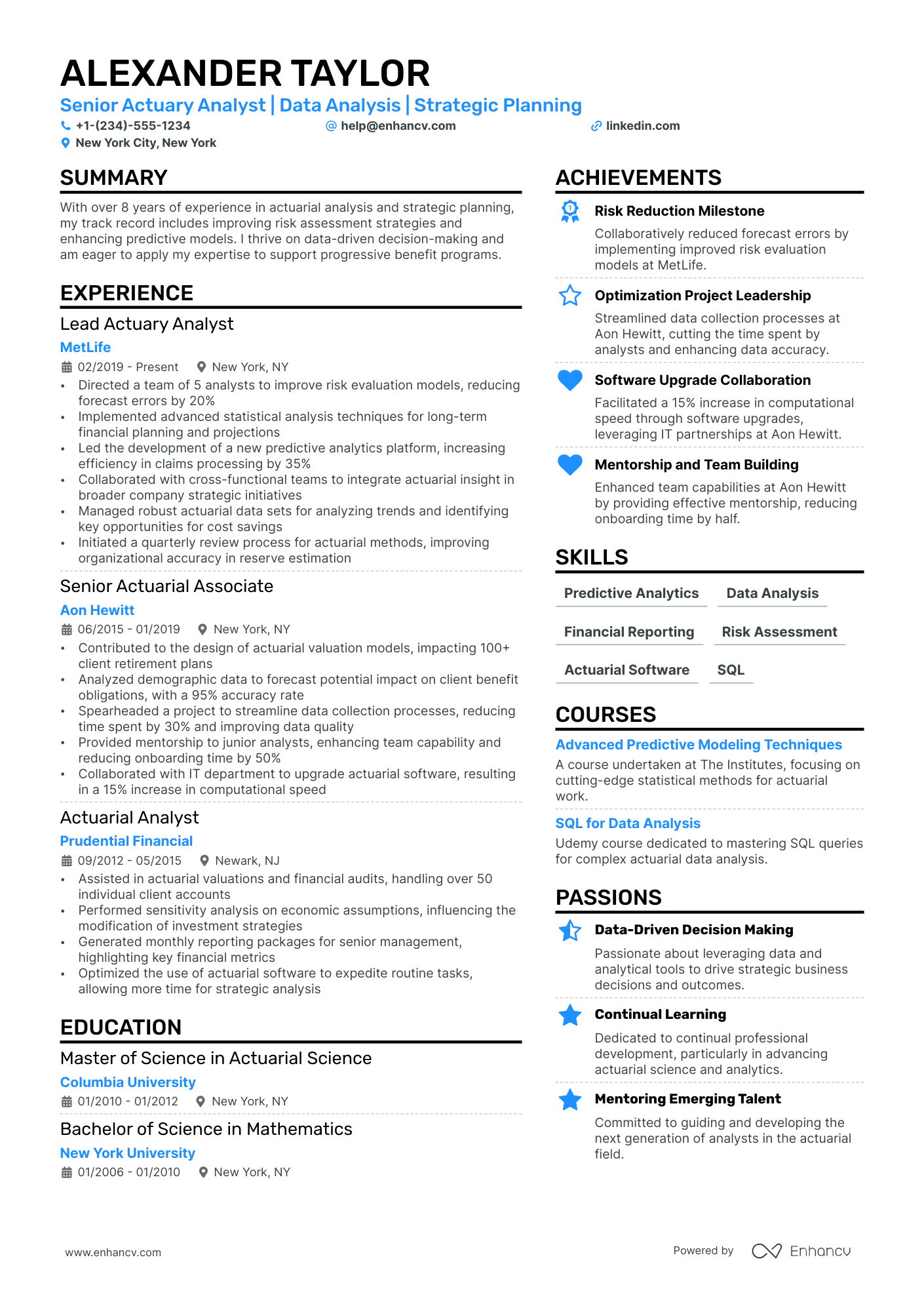

All Resume Templates Alexander Taylor Senior Actuary Analyst | Data Analysis | Strategic Planning +1-(234)-555-1234 help@enhancv.com New York City, New YorkWith over 8 years of experience in actuarial analysis and strategic planning, my track record includes improving risk assessment strategies and enhancing predictive models. I thrive on data-driven decision-making and am eager to apply my expertise to support progressive benefit programs.

Experience Lead Actuary Analyst 02/2019 - Present New York, NY Directed a team of 5 analysts to improve risk evaluation models, reducing forecast errors by 20%Implemented advanced statistical analysis techniques for long-term financial planning and projections

Led the development of a new predictive analytics platform, increasing efficiency in claims processing by 35%

Collaborated with cross-functional teams to integrate actuarial insight in broader company strategic initiatives

Managed robust actuarial data sets for analyzing trends and identifying key opportunities for cost savings

Initiated a quarterly review process for actuarial methods, improving organizational accuracy in reserve estimation

Senior Actuarial Associate Aon Hewitt 06/2015 - 01/2019 New York, NY Contributed to the design of actuarial valuation models, impacting 100+ client retirement plansAnalyzed demographic data to forecast potential impact on client benefit obligations, with a 95% accuracy rate

Spearheaded a project to streamline data collection processes, reducing time spent by 30% and improving data quality

Provided mentorship to junior analysts, enhancing team capability and reducing onboarding time by 50%

Collaborated with IT department to upgrade actuarial software, resulting in a 15% increase in computational speed

Actuarial Analyst Prudential Financial 09/2012 - 05/2015 Assisted in actuarial valuations and financial audits, handling over 50 individual client accountsPerformed sensitivity analysis on economic assumptions, influencing the modification of investment strategies

Generated monthly reporting packages for senior management, highlighting key financial metricsOptimized the use of actuarial software to expedite routine tasks, allowing more time for strategic analysis

Master of Science in Actuarial Science Columbia University 01/2010 - 01/2012 New York, NY Bachelor of Science in Mathematics New York University 01/2006 - 01/2010 New York, NY Key Achievements Risk Reduction Milestone Collaboratively reduced forecast errors by implementing improved risk evaluation models at MetLife. Optimization Project LeadershipStreamlined data collection processes at Aon Hewitt, cutting the time spent by analysts and enhancing data accuracy.

Software Upgrade CollaborationFacilitated a 15% increase in computational speed through software upgrades, leveraging IT partnerships at Aon Hewitt.

Mentorship and Team BuildingEnhanced team capabilities at Aon Hewitt by providing effective mentorship, reducing onboarding time by half.

Predictive Analytics Data Analysis Financial Reporting Risk Assessment Actuarial Software Advanced Predictive Modeling TechniquesA course undertaken at The Institutes, focusing on cutting-edge statistical methods for actuarial work.

SQL for Data Analysis Udemy course dedicated to mastering SQL queries for complex actuarial data analysis. Data-Driven Decision MakingPassionate about leveraging data and analytical tools to drive strategic business decisions and outcomes.

Continual LearningDedicated to continual professional development, particularly in advancing actuarial science and analytics.

Mentoring Emerging Talent Committed to guiding and developing the next generation of analysts in the actuarial field. www.enhancv.com www.enhancv.com

Entry Level Actuary

Entry Level Actuary

Entry Level Actuary

Entry Level Actuary

Entry Level Actuary

Entry Level Actuary

Entry Level Actuary

Entry Level Actuary

As an actuary, articulating your complex technical skills and experience in a way that's accessible to non-specialists can be a major resume challenge. Our guide offers clear strategies and examples to help you translate your actuarial expertise into compelling, understandable language that resonates with recruiters and hiring managers.

If the actuary resume isn't the right one for you, take a look at other related guides we have:

You don't need to go over the top when it comes to creativity in your Actuary resume format .

What recruiters care about more is the legibility of your Actuary resume, alongside the relevancy of your application to the role.

That's why we're presenting you with four simple steps that could help your professional presentation check all the right boxes:

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Privacy guaranteedAlways remember that your actuary certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

When it comes to your resume experience , stick to these simple, yet effective five steps:

You're not alone if you're struggling with curating your experience section. That's why we've prepared some professional, real-life actuary resume samples to show how to best write your experience section (and more).

Work Experience Senior Actuarial Analyst MetLife, Inc. 07/2018-OngoingLed the risk analysis team in developing predictive models to evaluate insurance liabilities, improving risk assessment accuracy by 25%.

Directed the implementation of a new actuarial software suite which streamlined workflow and reduced manual errors by 30%.

Successfully collaborated with underwriters to redesign life insurance products, leading to a 15% increase in sales.

Work Experience Actuarial Specialist Humana Inc. 01/2014-12/2019Conducted in-depth data analysis which contributed to a 20% reduction in claims overpayments and enhanced the profitability of the health insurance portfolio.

Played a key role in developing a strategy for entering a new market segment, which resulted in an additional revenue stream contributing to 10% of company's total revenue.

Pioneered the use of advanced statistical techniques that led to a more efficient allocation of capital reserves.

Work Experience Actuarial Consultant Prudential Financial, Inc. 05/2016-08/2022Spearheaded a project that enhanced annuity pricing models, leading to an 8% increase in competitive edge within the retirement solutions market.

Mentored a team of junior actuaries, enhancing their technical expertise and improving departmental productivity by 20%.

Analyzed complex data sets to forecast financial outcomes, assisting the organization to adjust strategies accordingly and realize a 5% cost saving on claims.

Work Experience Pricing Actuary The Travelers Companies, Inc. 03/2011-02/2017Managed the actuarial aspects of a corporate merger which resulted in streamlined operations and estimated savings of $1M per year.

Reviewed and updated actuarial pricing assumptions which contributed to maintaining a competitive edge in the property and casualty sector.

Facilitated regulatory compliance by developing rigorous financial reporting processes, significantly reducing the risk of non-compliance penalties.

Work Experience Actuarial Analyst III Liberty Mutual Insurance Group 06/2009-05/2013Instrumental in redesigning workers' compensation products, resulting in a 15% decrease in premiums while maintaining profitability targets.

Utilized Monte Carlo simulation methods to optimize reinsurance strategies, reducing the company's exposure to catastrophic risk by 20%.

Employed detailed variance analysis to explain budget discrepancies to stakeholders, improving transparency and communication.

Work Experience Product Development Actuary Allstate Corporation 11/2012-10/2018Led a cross-functional team in a project that revamped auto insurance pricing structures, achieving 12% growth in new policyholders.

Integrated big data analytics into the existing actuarial model, enhancing prediction accuracy by identifying new risk factors.

Coordinated with finance departments to ensure that reserves were optimally allocated for future claims, maintaining a solvency ratio above industry standards.

Work Experience Corporate Actuary Cigna Corporation 04/2013-12/2016Designed and conducted experience studies to refine mortality and morbidity assumptions, impacting the pricing of life and health insurance products positively.

Leveraged cutting-edge machine learning techniques to enhance the predictive power of traditional actuarial models, resulting in more competitive product offerings.

Engaged in corporate strategic planning sessions to provide insight on financial risk management, aiding executive decision-making.

Work Experience Lead Actuary 02/2017-OngoingOrchestrated the valuation of pension fund liabilities for numerous Fortune 500 companies, ensuring compliance with both GAAP and statutory reporting standards.

Deployed asset-liability management strategies to optimize investment portfolios, leading to a 6% better return on investment for clients.

Initiated and executed a department-wide upskilling program focusing on predictive analytics tools, which increased efficiency and service quality.

At Enhancv, we went through countless actuary resumes and uncovered which are the unique words people use to spice up their resumes. Forget about buzzwords - use these power words instead to make your experience section shine.

You're quite set on the actuary role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

Mention specific courses or projects that are pertinent to the job you're applying for.

Recruiters hiring for actuary roles are always keen on hiring candidates with relevant technical and people talents. Hard skills or technical ones are quite beneficial for the industry - as they refer to your competency with particular software and technologies. Meanwhile, your soft (or people) skills are quite crucial to yours and the company's professional growth as they detail how you'd cooperate and interact in your potential environment. Here's how to describe your hard and soft skill set in your actuary resume:

Statistical Analysis Software (e.g., SAS, R)

Actuarial Modeling Software (e.g., Prophet, MoSes)

Excel and Advanced Excel Functions

Programming Languages (e.g., Python, SQL)

Data Visualization Tools (e.g., Tableau, Power BI)

Risk Assessment Tools

Financial Reporting Software

Database Management Systems

Excel Add-ins for Actuarial Work

Machine Learning Techniques